Invoice Price Variance Process Accounting

Invoice Price Variance Process Accounting:

Note: Below Working and results are only applicable where Purchase Orders and Invoice are not routed through LCM Module. For LCM Enabled Items IPVs are routed and transferred to Inventory directly from LCM.

Invoice

Price Variance is variance between the invoice price and the purchase price for

all inventory and work in process related invoice distributions. Payables

records invoice price variances when the invoices are matched, approved, and

posted.

This Article covers the detail Accounting for Oracle Invoice

Price Variance Process and also its effect on item Unit Cost in Inventory.

Let's Put up a scenario here. We will be receiving an item

in Inventory which has currently no On Hand Balance or Unit Cost in Inventory.

We Booked a Purchase Order for Quantity 100 at Unit Price of BDT 10. We did the Receipt of the booked Quantity 100 at 01-August-2014 and receipt delivery was made on same date with all quantity accepted.

Before receipt of Invoice Quantity 90 was consumed and

charged to production on 03-August-2014 at Unit Cost of BDT 10. On

07-August-2014 Invoice was received with Value of BDT 1200 (100 Quantity x 12

Unit Price) against purchases made earlier and entered in system. Supplier had

increased the Price with BDT 2 per unit which will result in Invoice Price

Variance of BDT 200 which is transferred to Inventory.

Later at 09-August-2014 Quantity 5 (out of 10 remaining in

On Hand after 90 Issued) was identified to be damaged and returned back to

Supplier. The Invoice Line was discarded and Revised Invoice was entered in

System with value of BDT 1140 (Quantity 95 x Unit Price of BDT 12). This change

in invoice resulted in decreased Invoice Price Variance, the effect of which is

to be transferred to Inventory now.

Here are the Details as per above Scenario:

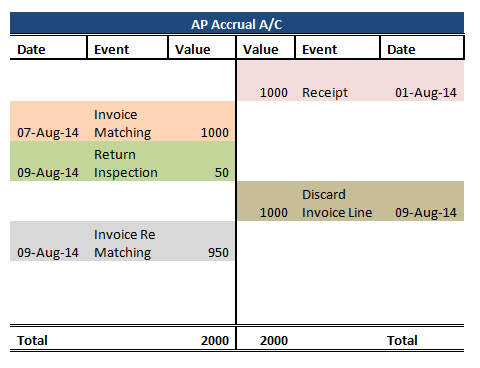

As per above information Accounting Entries for above events are as follows:

T Accounts:

Note: Rows with same color represent single

transaction entries.

* Full

IPV will be transferred to Inventory irrespective of whether purchased quantity

is available in inventory or issued. So effect of full value of BDT 200 will be

transferred to Unit Cost of 10 Units available and will increase unit cost of

Inventory Items from BDT 10 to BDT 30.

Before IPV Transfer:

Total Inventory Value

|

=

|

Quantity

|

x

|

Value

|

100

|

=

|

10

|

x

|

10

|

After IPV Transfer of

BDT 200 to Inventory Total Value:

Total Inventory Value

|

=

|

Quantity

|

x

|

Value

|

300

|

=

|

10

|

x

|

30

|

(So Unit cost of 30 is made by

dividing total inventory value by quantity available)

** As IPV is to be netted of at Completion of all

transactions, so only the differential value of 10 will be transferred to

inventory. Please check the T-Account for Invoice Price Variance.

Oracle Screen Shots:

Receiving Transaction Summary:

Item Cost History:

Material Transactions:

Accounting Entries in Oracle

Excellent Article.

ReplyDeleteDid you process the average cost update manually to shift the IPV to Inventory or is there any standard functionality that automatically generates the Cost update?

@faizan Thanks. There is standard request available in Cost Management SLA to transfer the IPV to inventory.

ReplyDelete